2025 Property Taxes

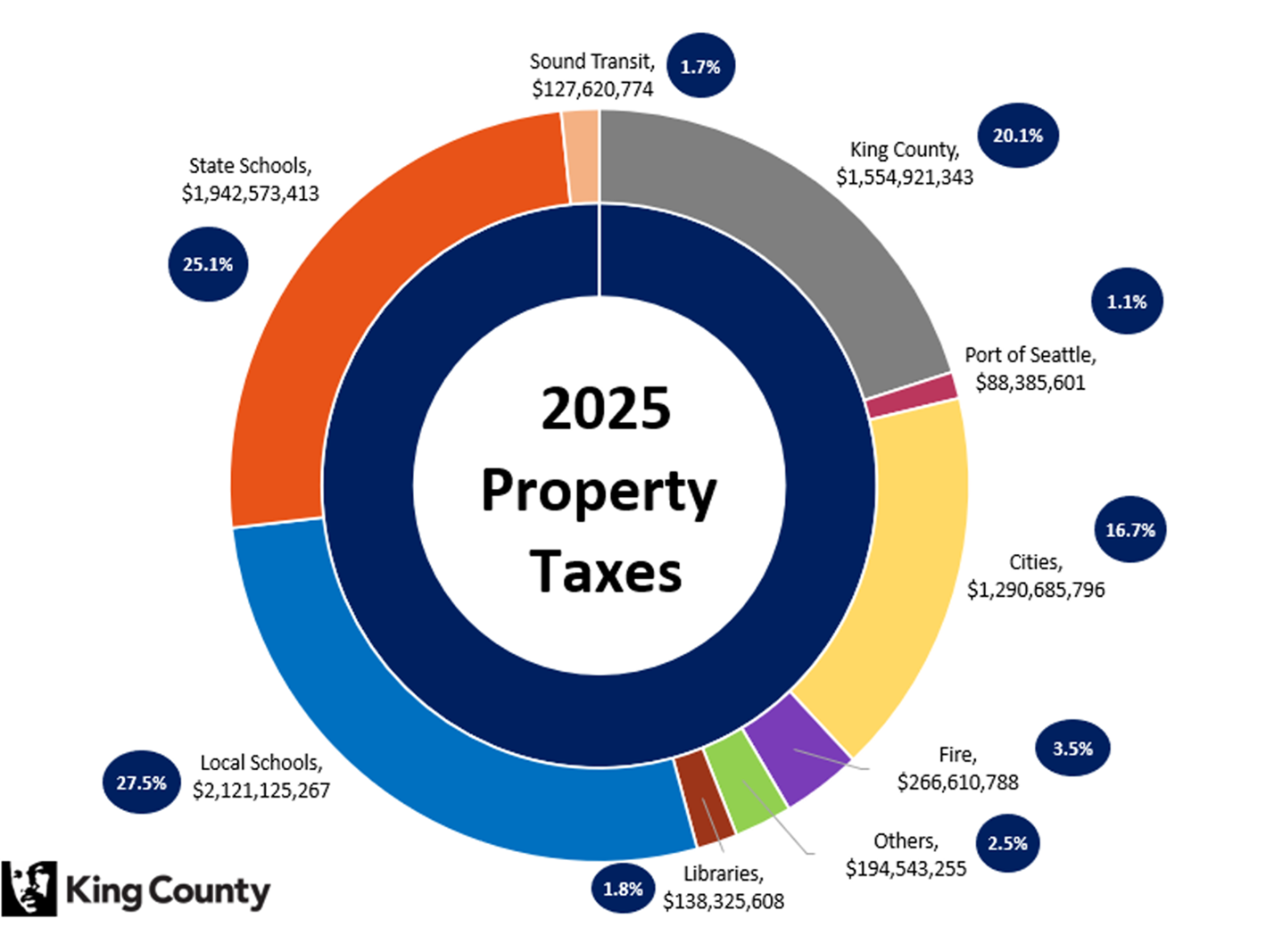

Where do my property tax dollars go?

We collect taxes for the state, the county, cities, and taxing districts like schools. Then we distribute the revenue back to them. Taxes also fund voter-approved measures for veterans, seniors, fire protection, and parks. For the most part these voter-approved measures, and not increasing property values, are responsible for increases in property taxes.

King County gets about 20% of your property taxes to fund services like roads, criminal justice, and public health.

Here's how it breaks down:

2025 PROPERTY TAX HIGHLIGHTS

Overall property taxes for the 2025 tax year are $7.7 billion, an increase of approximately $121 million or 1.6% from the previous year of $7.6 billion. Total County property value increased by approximately 4.8%, from $833 billion in 2024 to $873 billion in 2025.

After historic and dramatic fluctuations in values earlier in the decade, housing values have reverted to a more moderate rate of growth.

Listed below are other contributing factors to the above statistics.

City District Stats:

- The highest residential property tax increase for 2025 is in the City of Kenmore and the City of Tukwila at 15%. A significant factor was the passage of a fire district levy in Kenmore, and school levies in Tukwila. See below. The other significant factor in Tukwila is the city annexing into Fire District 63, which increased the levy rate in that tax code area by more than $0.89.

- All cities had an increase in median home value with the City of Newcastle increasing the highest at 19.5%.

- Only 3 districts had tax decreases, the City of Federal Way, City of Medina, and Vashon Island.

- Only two cities had an increase in levy rate, the City of Seattle and City of Tukwila.

Lid lifts and Special Levies Passed for the 2025 tax year:

-

Voters in these Cities approved the following property tax measures.

City of Seattle: 8-year temporary lid lift for Transportation. Qualifying Seniors/disabled taxpayers are exempt from this lid lift. - Voters in these Fire Districts approved the following property tax measures.

FD 16 (Kenmore/Lk Forest Park) 1-year permanent lid lift to $0.70/$1,000

FD 22 (Milton) 1-year permanent lid lift to $1.50/$1,000 (Shared district with Pierce County) - Voters in these School Districts approved the following property tax measures.

SD 402 (Vashon) 4-year Replacement for Expiring Capital Levy for Safety and Technology Improvements

SD 406 (Tukwila) 4-year Replacement levy for Expiring Educational Programs and Operations Levy

SD 406 (Tukwila) 4-year Renewal levy for Tech & Capital Projects

SD 408 (Auburn) 4-year Replacement levy for Expiring Educational Programs and Operations Levy

SD 408 (Auburn) 20-year Bond Measure for a New Middle School

SD 409 (Tahoma) 2-year Replacement for Expiring Technology Capital Projects Levy

SD 409 (Tahoma) 2-year Replacement M&O Levy

SD 411 (Issaquah) 20-year Bond Measure for Facility Upgrades

SD 414 (Lk Washington) 6-year Capital Project: Rebuilding 2 Elementary Schools

SD 415 (Kent) 3-year Special Replacement Levy: Educational Programs/Operations

SD 415 (Kent) 3-year Special Levy for Capital Project: Renovation

View valuations, property characteristics, levy rates, and sale history

Contact us

General Info: 206-296-7300

TTY: 1-800-833-6388

Senior Exemptions: 206-296-3920

Email: assessor.info@kingcounty.gov

Provide advice and assistance on property tax related matters including appeals

Contact us

Telephone: 206-477-1060

Toll Free: 1-800-325-6165 ext. 7-1060

TTY Relay: 711

Fax: 206-296-0948

Email: taxadvisor@kingcounty.gov

First half of 2025 property taxes are due

April 30th

Sign up for TEXT or EMAIL Reminders

Contact us

Property Tax Hotline: 206-263-2890

Foreclosure: 206-263-2649

Email: PropertyTax.CustomerService

@kingcounty.gov

201 S. Jackson St., Second Floor

Seattle, WA 98104

Translate

Translate