King County 2026-27 Budget Process

This fall, the King County Council reviewed and adopted a two-year $20.16 billion budget for 2026 and 2027. The budget is one of the most important things the County works on as it determines our future and sets our values in motion. You’ll find important information below about the proposed and final adopted budget.

Council approves $20 billion budget focused on public safety, shoring up basic needs

The King County Council on Tuesday voted to approve the next biennial King County budget, a $20.16 billion spending plan that avoids cuts to public safety, shores up basic needs in response to federal cuts and boosts government accountability.

“With passage of the County’s 2026-2027 biennial budget, I’m thankful for the meaningful progress we’ve delivered for the people of King County,” said King County Councilmember Rod Dembowski, who chaired the budget committee. “The Council worked to protect essential public safety investments, strengthen our commitment to combating hunger, and increase accountability for how public money is spent. I’m grateful to Executive Braddock for her leadership and to my Council colleagues for their thoughtful collaboration.”

The Council’s Budget Leadership Team built on the Executive’s proposal to boost funding for food security, housing and homelessness, accountability and more.

Key highlights of the budget include:

Public Safety & Criminal Justice

- $175 million to protect sheriff’s deputies, prosecutors, and support staff; maintain courthouse patrols; preserve services that reduce gun violence, support survivors of domestic violence and sexual assault, and provide reentry education.

- $30 million to expand juvenile probation officers, public defenders, and court interpreters; recruit sheriff’s deputies; preserve homeless shelter services; and grow behavioral health and victim support programs.

- Council adds: $18 million for behavioral health, including crisis response, restoring MIDD cuts, and stabilizing mobile crisis providers.

- $2.3 million for sexual assault and domestic violence services, including Harborview’s Abuse and Trauma Center, King County Sexual Assault Resource Center, CASA survivor services, and MIDD behavioral health initiatives.

Housing, Homelessness Response & Health

- $5 million to keep the SoDo shelter open through 2027; $3 million for 80 new shelter beds in Federal Way; and $3 million for families, youth, and young adults facing housing insecurity.

- Council adds: $3.2 million for Kenmore and Reclaim shelters, three tiny home villages, and youth providers; $3 million for rental assistance, with potential for $3 million more in 2026.

- $4 million to expand food access across the region.

- Council adds: $9 million more for food banks, including capital funding, VSHSL levy support, bus tickets for residents affected by grocery closures, and programs in unincorporated King County.

- $31 million from hospital tax funds to protect health care against federal cuts, plus $8 million contingency for behavioral health.

- Council adds: Potential $3 million for Continuum of Care from 2025 underspend to be used in 2026.

Transit

- More than 400,000 hours of bus service to restore suspended routes and meet demand.

- Investments in Link light rail, Dial-a-Ride, Access paratransit, water taxi, and Metro Flex.

- Extended transit security, Metro Transit Police staffing, and SaFE Reform initiative.

- Council adds: Continued Juanita Metro Flex and Seattle waterfront shuttle; plan to move to cashless fares; restroom pilots at Shoreline and Burien transit centers; bus route security report and consultant support for Transit Safety Task Force.

Accountability & Best-Run Government

- $10 million to strengthen financial management, internal controls, and contract oversight at the Department of Community and Human Services.

- Council adds: $500,000 for internal audit; required risk assessments for grant-issuing departments; quarterly and semiannual reporting on grants and contract management; behavioral health system audit; and regular briefings on wastewater capital projects.

- $3 million to develop a countywide Artificial Intelligence policy and innovation fund to protect privacy, prevent bias, and promote responsible use.

- Efficiency measures to modernize technology, bring services in-house, and reduce costs.

Other Council Adds

- $1.6 million for immigrant and refugee services, including $1 million for NWIRP and $250,000 for Mujer al Volante driver training and license assistance.

- $1.4 million for housing, including pre-development for the Youth Achievement Center and Bellevue Family YMCA, plus Home and Hope program support.

- $350,000 for LGBTQ+ community services.

- $3.85 million for workforce development, including $800,000 for pre-apprenticeship programs in Federal Way and Auburn.

With passage of the County’s 2026-2027 biennial budget, I’m thankful for the meaningful progress we’ve delivered for the people of King County. The Council worked to protect essential public safety investments, strengthen our commitment to combating hunger, and increase accountability for how public money is spent. I’m grateful to Executive Braddock for her leadership and to my Council colleagues for their thoughtful collaboration.

I’m proud of the investments we are making to strengthen our workforce, invest in food security, and improve the health and well-being of our community’s most vulnerable. This budget is being released in the very moment we are seeing federal dollars disappear for housing and the imposition of impossible restrictions that will weaken the continuum of care that allows people to be stably housed. While the county alone cannot make up for the reductions in these needed services, the investments in stable public health services, rental assistance, and workforce training in this budget will make our community more resilient as we face these threats.

This budget is something for King County to be proud of because it represents our values so well. With it, we are planning for the future by investing in hope, caring for the present by providing for our most vulnerable populations, and correcting the mistakes of the past by helping lead the nation with important work on climate change, transportation and social justice. I’m proud to have been of service at this critical time where the need for vision and leadership in local government has never been greater.

I’m grateful to have worked with my Council colleagues and Executive Braddock to craft a responsible and responsive 2026-2027 King County Biennial Budget. Not only did we shore up all the areas previously at risk of losing funding due to the deficit we were facing, but we ultimately approved a budget that funds critical needs in our court system and Sheriff’s Office, invests in vital infrastructure, and supports human services for our most vulnerable—ensuring all of King County can thrive.

This budget is designed to provide stability to essential county services and guide our county through what promises to be a challenging two years. While we've made key investments to sustain vital services, including youth homelessness programs and the justice system, our capacity to expand critical areas that will face increasing pressure in the coming years is limited. To navigate these challenges, collaboration with our city, state, and local partners will be essential.

I would like to thank Councilmember Dembowski for his leadership and the entire Council for their hard work in passing this biennial budget. This budget reflects our shared values, avoids cuts to public safety, and bolsters funding for key priorities like housing and homelessness, transit, public health, and food security. At its core, this budget is about keeping King County a place where every person can thrive.

![]()

Public Comments

Thank you for sharing your comments about the King County budget. Your voice matters, and has helped us shape the King County budget—a two-year plan that funds the services and priorities that keep our communities running.

![]()

Who Decides?

The process begins with the Executive’s proposal in September and concludes in November after Council-led public hearings, deliberations, and amendments. This is one of the Council’s most important responsibilities, because it determines how policy becomes action in people’s daily lives.

![]()

What is the County Budget?

The King County budget is more than numbers — it’s our community’s plan for the next two years. It reflects the values we share as a region and sets the course for how we invest in health, safety, housing, transit, parks, and opportunity for all residents. Every dollar is a decision about what kind of community we want to be.

![]()

Your Tax Dollars at Work

Your tax dollars provide residents with many things, including Metro transit, public health clinics and emergency medical services, law enforcement, parks and trails. These funds also give us clean water, garbage pickup, roads in unincorporated areas, and services that help veterans, seniors and kids.

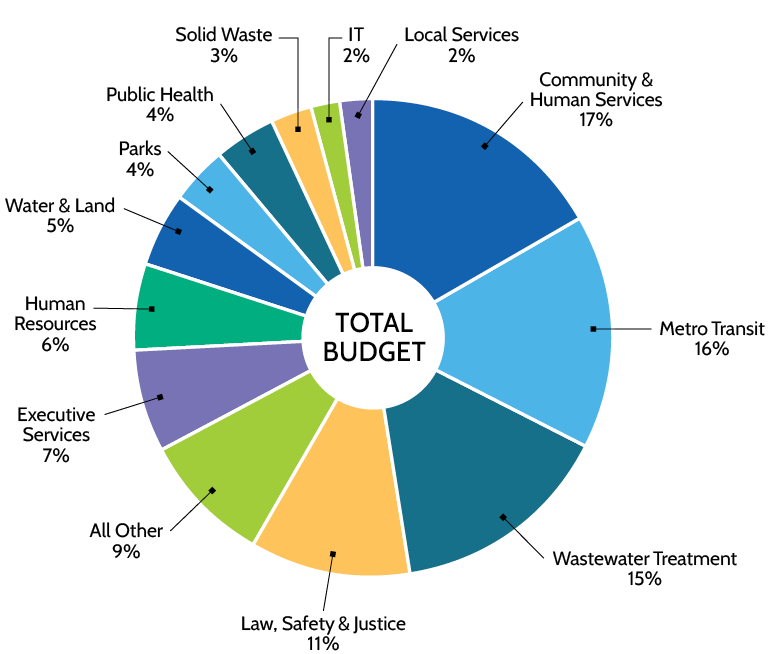

The Big Picture

Every dollar is an investment in safe, healthy, and sustainable communities.

TOTAL SIZE

$19.7+

BILLION

Across many funds.

RESTRICTED FUNDS

83%

Must be spent on specific things, like wastewater and voter-approved levies.

GENERAL FUND

17%

Flexible fund that pays for local priorities.

Where the money comes from:

- Property tax

- Sales tax

- State and federal funds

- Rates and fees

Where the money goes:

- Transit: buses, vans, Water Taxi

- Health: clinics, emergency medical services, public health

- Law and Justice: courts, Sheriff, transit security

- Healthy Environment: parks, trails, clean water, salmon recovery

- County Operations: elections, property assessments

- Investing In Residents: veterans, seniors, and kids

- Unincorporated Area Services: roads, permitting

Budget Breakdown

The General Fund

Why the General Fund Gets Attention

The General Fund is only 17% of the total budget, but it covers many services that don’t have a dedicated funding source. This is where the Council has the most flexibility — and where we can turn our local priorities into action.

A small slice of the budget with an outsized impact, the General Fund pays for health, justice, safety, and democracy in King County.

General Fund Services Include:

- Courts

- Prosecuting Attorney

- Public Defense

- Sheriff and investigations

- Jails & detention

- Elections

- Emergency management

- Public health

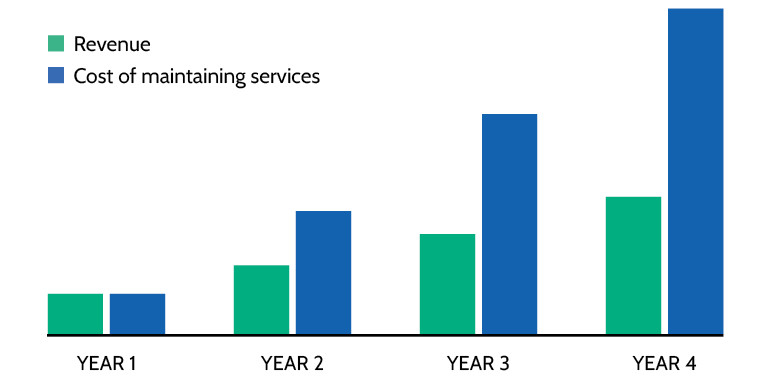

Persistent Deficit

Like households, King County’s costs rise each year — healthcare, labor, and construction get more expensive. But state law caps property tax growth at just 1% per year. Over time, revenues can’t keep up with costs, leading to an ongoing/persistent budget gap.

Even with this challenge, King County leads with responsibility and fairness — balancing budgets while protecting critical services and planning for the future

The Effect of the Persistent Deficit

Budget Timeline

-

September

Executive proposes new budget.

-

October

Council hearings and public input.

-

November

Council adopts final budget.

-

January 2026

New budget takes effect.

Did You Know?

![]()

Elections

Every election, King County mails over 1.3 million ballots and operates 70+ secure drop boxes across the region.

![]()

Transit

Metro provides over 250,000 rides on busy days.

![]()

Parks and Trails

King County maintains 28,000+ acres of parks and 250 miles of regional trails that connect communities.

![]()

Quick Guide: County, City or State?

COUNTY: Metro Transit, public health, district and superior court, jails, elections, zoning and sheriff in unincorporated areas, regional parks.

CITIES: Police, fire, local roads, neighborhood parks.

STATE: Highways, state patrol, universities, statewide laws

Translate

Translate