2021 taxes

King County to Mail First Tax Bills Since the Beginning of the Pandemic: Some Areas Will See Increases Due to the Passage of Special Levies

COVID 19 Pandemic Has Not Affected Home Values, but Some Commercial Businesses Have Taken a Major Hit

Overview of 2021 Property Taxes

Voter approval of special levies, in conjunction with a strong housing market, will generate a 4.03% general increase in King County property tax collections for 2021 – although some jurisdictions will see double digit increases.

Overall, countywide property tax collections for the 2021 tax year are $6.6 billion, an increase of $256 million from the previous year of $6.3 billion. Total County property value increased by 2.65%, from $642.5 billion to $659.5 billion between 2020 and 2021.

“This year’s tax bills reflect the complexity of our property tax system,” said Assessor John Wilson. “Taxes are going up for many county residents, but not all. And the pandemic which has affected all our lives has hit the economy hard, but has not dramatically affected property values.”

King County Treasury will begin sending out the annual property tax bills February 16. King County collects property taxes on behalf of the state, the county, cities, and taxing districts (such as school and fire districts), and distributes the revenue to these local governments. Click here for more information

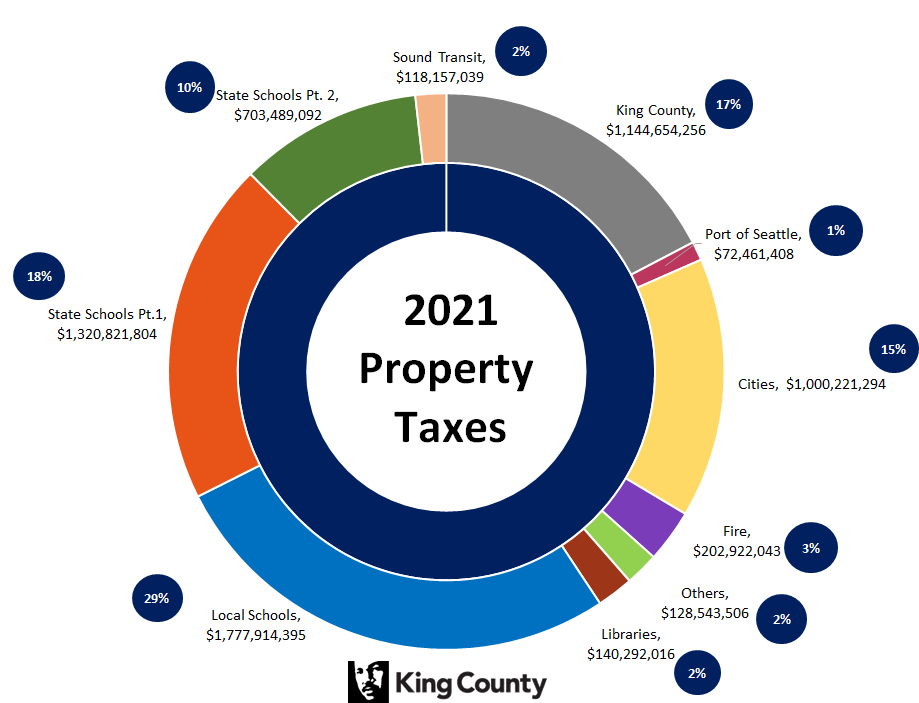

About 57 percent of 2021 King County property tax revenues pays for schools. Property taxes also fund voter-approved measures for veterans and seniors, fire protection, and parks. King County receives about 17 percent of your property tax payment for roads, police, criminal justice, public health, elections, and parks, among other services.

Local Levies Lead to Property Tax Increases

By state law, property taxes are calculated on values set January 1, 2020 – well before the economic impacts from COVID-19. During 2020, many local special levies, particularly for schools, were passed by voters. Taxes to fund those levies will be collected for the first time this year, leading to property tax increases in many parts of the county.

For example, the four largest increases are in Pacific, up 13% over 2020, Enumclaw, up 11%, Maple Valley, up 15%, and Algona, up 18%. The increases in Maple Valley and Enumclaw are the result of voters approving new levies in the Tahoma and Enumclaw school districts. The increases in Pacific and Algona are due to the passage of two levies in the Auburn School District, and the passage of a new levy by the Valley Regional Fire district.

Property taxes vary depending upon location, the assessed value of the property, and the number of jurisdictions levying taxes (such as state, city, county, school district, port, fire district, etc.). A number of levies and other property tax measures were approved by voters in 2020 for collection in 2021, and are the main factors driving property tax increases in some parts of the county They include:

- City of Kirkland: One-year permanent levy lid lift

- Si View Metropolitan Park District: One-year permanent levy lid lift

- Fire District 61 (Valley Regional Fire Authority) – One-year permanent lid lift

- Five (Auburn, Issaquah, Kent, Tahoma, and Tukwila) of the 20 school districts in King County passed Enhancement levies, for a total of $531,309,616.

- The Enumclaw, Auburn, Tahoma, Tukwila and Highline School Districts all passed Capital Projects levies.

- Bellevue School District passed an unlimited bond for $675m over 20 years.

- King County – Passed a 20-year, $1,740,000,000 bond measure for capital improvements to Harborview Medical Center.

- Three fire districts (#27 Fall City, #39 South King and #44 Mountain View) passed 4-year M&O levies

(Click here to see a spreadsheet showing the changes by city)

Property Values Largely Unaffected By the COVID-19 For 2021 Taxes

The King County Assessor has been monitoring the economic impacts of the COVID-19 pandemic. While residential housing values have remained steady, some commercial sectors are being heavily impacted. It is important to note, however, that, by state law, values are set as of January 1 each year. Taxes collected this year are based on the value of the property on January 1, 2020. Therefore, any changes in commercial values caused by COVID will be reflected in the 2021 assessed value for taxes payable in 2022.

“The world today is radically different than it was on January 1, 2020 when state law has us set assessed values for this year’s taxes,” said Wilson. “While residential values have been steady, many businesses have been either temporarily closed or their operations dramatically constrained. And thousands of workers have been laid off or furloughed.”

Last year the Assessor launched an online portal to allow commercial property owners to inform King County of impacts to their property value. Commercial taxpayers should go here: https://www.kingcounty.gov/COVID-value-review to report these COVID impacts.

“We want to accurately capture the effects COVID has had on commercial property values,” said Wilson. “This portal will help us do that. And we hope the legislature will take action on legislation we have proposed to help these commercial properties now.”

Click here for Property Tax 2021 Presentation (.PDF, 2,674KB), Audio (.MP4, 15MB)

Seniors and the Disable May Be Eligible for Tax Relief

For seniors and the disabled, it is important to be aware of our state’s property tax relief programs. King County taxpayers who are 61 years or older, or disabled, own their home, and have an annual income of $58,423 or less after certain medical or long-term care expenses, may be eligible for tax relief. Taxpayers should visit this site: https://www.kingcounty.gov/depts/assessor/TaxRelief.aspx for more information and to apply online.

During 2020 we saw a more than 300% increase in the number of residents applying for Senior Exemptions. We expect more homeowners to apply in 2021. Processing applications with staff working at home due to the pandemic has been a challenge, but King County is doing everything possible to swiftly process applications.

Property owners can find tax levy rates and more property related information by visiting the eReal Property Search on the King County Assessor's website or by calling 206-296-7300.

Assessor eReal Property Search

View valuations, property characteristics, levy rates, and sale historyContact us

General Info: 206-296-7300

TTY: 1-800-833-6388

Senior Exemptions: 206.296.3920

Email: assessor.info@kingcounty.gov

King County Tax Advisor

Provide advice and assistance on property tax related matters including appealsContact us

Telephone: 206-477-1060

Toll Free: 1-800-325-6165 ext. 7-1060

TTY Relay: 711

Fax: 206-296-0948

Email: taxadvisor@kingcounty.gov

Pay your property taxes

First half of 2021 property taxes are due April 30thSign up for TEXT or EMAIL Reminders

Contact us

Property Tax Hotline: 206-263-2890

Foreclosure: 206-263-2649

Email: PropertyTax.CustomerService

@kingcounty.gov

500 4th Avenue RM 600 Seattle, WA 98104

Where Do Your Property Tax Dollars Go?

A day in the life of a King County Appraiser

Tax Advisor Office

How King County's revenue falls behind even as property taxes go up

KEY DATES 2021

- April 30th First half of property taxes due (If taxes are less than $50, full payment is due.)

- April 30th Personal property listing forms due

- June 1 Three percent penalty assessed on delinquent taxes

- July 1 Appeals to the County Board of Equalization must be filed by July 1 or within 60 days of notification.

- Sept. 1 Applications for limited income deferrals due

- Oct. 31 Second half of property taxes due

- Dec. 1 Eight percent penalty assessed on delinquent taxes

KEY LINKS

- Senior Exemption Portal - Online filing for tax relief

- eReal Property - View parcel characteristics, values and sale history

- eSales - Search sales for comparison

- eListing - File Personal Property Listing Online

Translate

Translate